The Federal Reserve met last week, and Chair Jay Powell indicated tapering this year is more likely than not. The decision on when to reduce the central bank’s purchases of government-backed bonds will likely be affected by the employment report released a week from Friday. If labor market strength resumes, the Fed appears likely to roll back its support.

Key Points for the Week

- The Federal Reserve left rates unchanged and signaled tapering would likely begin later this year.

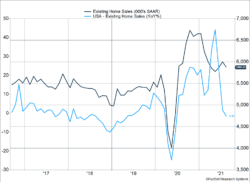

- Existing and new home sales remain above the pre-COVID-19 trend and prices are strong, even though yearly comparisons are turning negative when compared to the housing surge late last year.

- Concerns about a government shutdown, along with elections in Canada and Germany, are expected to have a minor effect on markets.

The biggest factor causing housing data to weaken is how strong it was last year. Existing home sales dropped 2% from the previous month and a similar amount compared to last year. New home sales have dipped 20% from last year. As Figure 1 shows, even though sales have turned slightly negative, the number of existing home sales remains comfortably above pre-COVID levels.

The S&P 500 added 0.5% in a volatile week. The MSCI ACWI gained 0.1%. The news from the Federal Reserve pressured bonds. The Bloomberg U.S. Aggregate Bond Index sagged 0.4%. Inflation will be the top focus this week as the PCE price deflator will provide additional perspective on how inflation pressures might affect markets.

Figure 1

Tapering Off

Last Wednesday, the Fed signaled it intends to announce the first reduction in the bond purchasing program related to the pandemic as early as the November FOMC meeting. Through this program, the Fed is buying around $120 billion per month to help stimulate the economy as it recovers from the pandemic. Some experts were expecting an announcement to come at last week’s meeting, but the combination of slowing growth from the rise of the Delta variant and data showing inflation is returning to normal levels pushed those expectations back.

At the same time, the Fed produced its expectations for growth and inflation over the next few years through the release of the Summary of Economic Projects (SEP). This report showed Fed officials adjusted their estimate for GDP growth this year down to 5.9% (from 7.0% in June) but increased their estimate to 3.8% for 2022 (3.3% previously). Essentially, they think the Delta variant will push some of the growth they anticipated for this year into next.

On inflation, Fed officials increased their PCE estimates for this year to 3.7%, while also increasing their expectations for 2022 and 2023. Chair Powell is sticking to his belief that current inflation is transitory but other events may cause more persistent inflation, such as extreme weather events.

The Fed’s plan may be complicated by timing of rate hikes in the future. Powell has been careful to “decouple” the tapering of the balance sheet and the timing of rate hikes over the past few months. He stressed that the U.S. is getting close to reaching targets for inflation and employment, which is why a reduction in bond buying is likely before year-end, but the thresholds for raising rates were stricter. What that means for the liftoff from zero remains to be seen, especially after this month’s more hawkish “dot plot” showed half of the members expecting at least one rate hike next year. For comparison, none of the FOMC members thought there would be a rate hike next year during the survey in March.

The debate around passing a government spending bill, which must be approved by Sept. 30, is drawing attention. The discussion will likely continue in October when Congress must decide whether to raise or suspend the debt ceiling. The House of Representatives approved a bill last week that would keep the government running, but it may prove difficult to pass the Senate.

It’s important to remember that debt ceiling increases are a natural outcome of spending to support the economy and are fairly common. The debt ceiling has been suspended or increased 78 times since the 1960s, regardless of which party is in power – 49 times under Republican presidents and 29 times under Democratic presidents. However, political posturing from both sides has also become part of the routine. Our expectation is a deal is reached at the last minute and the market impact is small.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20210922.pdf

https://blog.pimco.com/en/2021/09/fed-policy-amid-elevated-inflation-concerns

Compliance Case #01141635